You can never protect anything completely, but we can try to mitigate the risk involved by taking necessary action before the loss occurs. In businesses, the best supply chain risk mitigation technique is to insure every single nail until it remains the owner's responsibility. In recent years, several supply chain disruptions have occurred (We will summarize in this article) and companies overcome financial loss only by the contingency plan ‘Marine Insurance’. Even now, Marine insurance is not a mandatory requirement for all shipments in many countries, every country has their regulations concerning Marine Insurance, and the below link shows the summary of Marine Insurance law in every country. https://www.if-insurance.com/globalassets/industrial/files/marine-cargo/english-clauses/list-of-countries-with-restrictions-marine-insurance.pdf

WHAT IS MARINE INSURANCE?

Marine Insurance or Cargo Insurance, covers the financial loss or damage of goods during transportation via sea, air, road, or rail. There are three main Institute Cargo clauses to determine the policy type, Clause A - Covers overall risk during transportation, Clause B - Medium coverage, and Clause C - Minimum coverage. Claims will be issued according to the policy type insured.

TYPES OF MARINE INSURANCE EXPLAINED

There are several Marine Insurance types, in this article, let us explain key topics.

- Marine cargo Insurance - Covers the value of the goods, if the shipment is damaged, lost, or misplaced goods during transportation by rail, truck, sea, or air

- Freight Insurance - Covers the freight charges, if the shipment is lost, damaged, or misplaced in any mode of transportation.

- Hull Insurance - Covers the damage of the ship, vessel, or machinery associated with the ship. This type of coverage is insured by the ship owner or operators to overcome the financial risk of repairing the ship or replacing the ship/vessel or any machinery.

- Liability Insurance - covers any liability caused due to the ship accident or attack.

- Demurrage Insurance - Covers the cost of the shipment delay due to operations

MAJOR SUPPLY CHAIN DISRUPTIONS IN RECENT YEARS

- US - CHINA Trade War (2018)

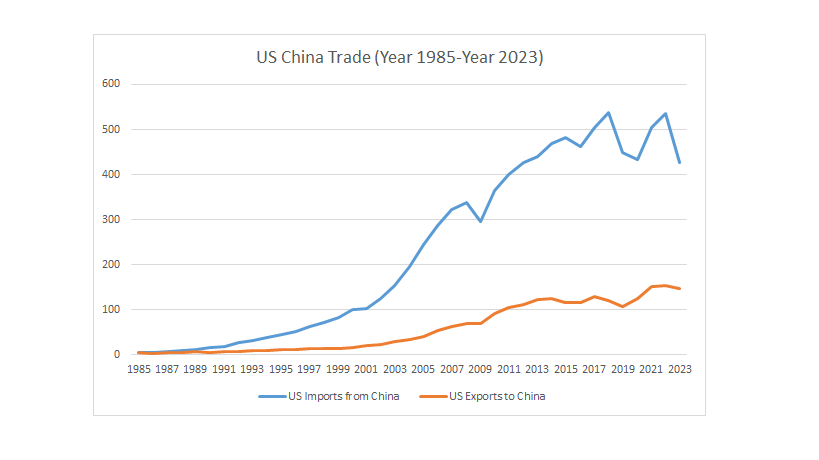

China does not utilize many United States products, whereas China is one of the top exporters to the US market. Due to unfair trading, the US has imposed tariffs against Chinese imports. This impact results in many conflicts such as market instability, businesses having to shift their hub by the needs, product price fluctuates and uncertainty in planning the demand, and technological impact due to the unavailability of products. Businesses ensuring to insure the shipping of goods will be able to overcome the financial risk during shipment transportation, risk of the payment or compliance, and geopolitical risk during transportation and increase the confidence level of the firms in supporting the supply chain resilience enabling business continuity.

United States and China Trade from the Year 1985 to 2023

2. COVID-19 - 2020 and still undergoing

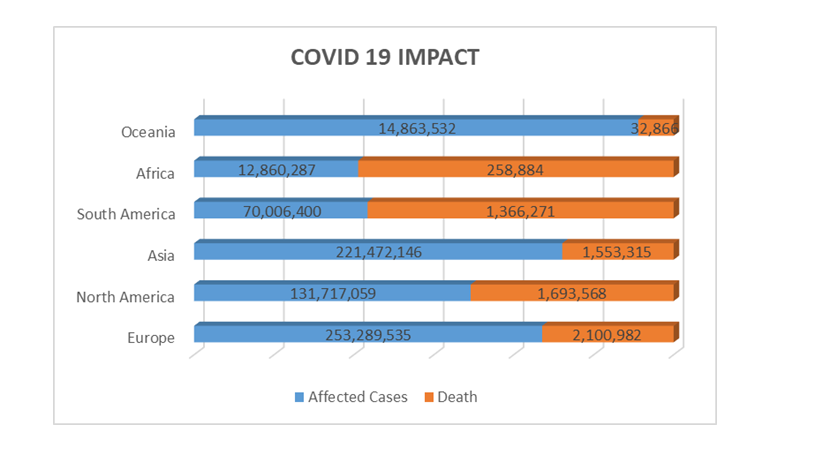

The worldwide pandemic situation happened in the year 2020 due to the coronavirus spreading to the people, and death of over 7 million in the last 3 years. The major affected countries are the US, India, France, Germany, Brazil, South Korea, Japan, Italy, the UK, Russia, and so on. Due to the vigorousness of the virus spread, country lockdowns and quarantines had to be imposed. Thus, there was a major impact on the supply chain operation and resulted in a shortage of food, medical facilities, and personal hygiene products in several areas of the world. The entire supply chain system was corrupted resulting in production delays, shipment delays, port congestion, marine traffic, high shipping cost, demand uncertainty, price instability, distribution delays, technological devices demand increases due to remote working, misplacement or loss of shipment, damage of the shipment and so on,

Number of Covid affected cases versus death - Worldwide

Many small-scale companies shut down during this period due to the lack of risk mitigation strategies such as insuring the businesses to protect from financial loss, outdated technology practices that failed to remote access, lack of technological knowledge employees to do work effectively during quarantine, improper customer supplier management to approach credit facility and so on, Companies with the best supply chain resilience strategy during Covid 19 was able to continue the business with minimum loss compared to others. As such, Maine Insurance supported the major supply chain operations in taking risks to supply the goods necessary to any destination, especially medical and food needs.

3. SUEZ CANAL blockage (2021)

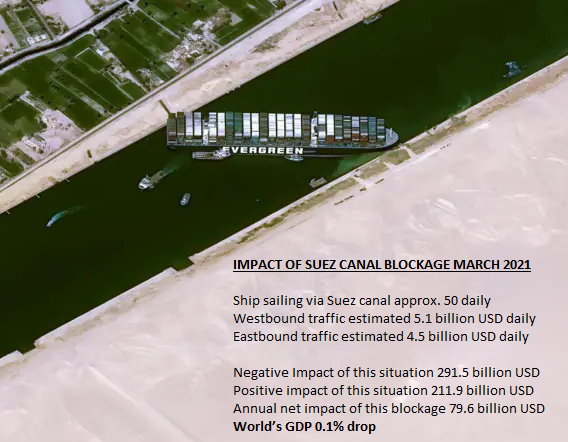

The Suez Canal (Owned by the Egyptian Government) is an artificial waterway, dividing Asia and Africa that connects the Red Sea and the Mediterranean Sea. This canal is constructed to exploit the direct route between Europe and Asia to save around 8,900 Km distance (8 to 10 days). It is the busiest way, with around 50 vessels or ships sailing daily via the Suez Canal. It was estimated that around 12% of global trade happened via the Suez Canal daily, worth 9 to 10 billion USD. On 23rd March 2021, the ship Ever Given struck horizontally across the canal and took six days to clear the ship with great difficulty. This impact has made the overall supply chain operations a disaster, resulting in a higher economic drop. During this period, over 400 ships reached the destination using alternative routes via the Cape of Good Hope in South Africa resulting in additional cost and time. Due to this most of the countries underwent a negative economic impact of 291.5 billion USD (Most affected countries: China -73 billion USD, India -26.2 billion USD, Israel -20.4 billion USD, EU = -72.9 billion USD), whereas certain countries obtained a positive impact of 211.9 billion USD (Most gained countries: US 59.9 billion USD, Japan 32 billion USD, Brazil 20 billion USD, Australia 18.2 billion USD). Because this impact increases the price of the products and decreases the demand for the product, it faced heavy competition among the firms. Thus, the countries that were not dependent on the goods passed via the Suez Canal benefitted from this blockage. Even though, the overall supply chain was corrupted the owners of the Ever Given (Shoei Kisen Kaisha) ship have claimed a specific amount from the Insurance company to cover the damage, and loss of the blockage, the amount was disclosed due to the agreement between the insured and insurer.

Image from ‘The New York Times’ - Suez Canal obstruction

4. RUSSIA - UKRAINE WAR (2022 still undergoing)

Ukraine gained independence from the USSR (Union of Soviet Socialist Republic) in 1991, they were acting independently in the world for over 2 decades. Due to the illegal annexation of Crimea by Russia, Ukraine has decided to join NATO (North Atlantic Treaty Organization) for the security of their country and to get support from NATO armed forces to protect against Russian attack, to get more economic and political stability, to get partnership with Europe. Russia invaded Ukraine for that reason, because most of the Russian border countries towards Europe joined NATO, excluding Ukraine and Belarus. Due to this, Russia has an insecure border that has covered up its borders with NATO military forces. This ended with the War between Ukraine and Russia on 24 February 2022 and still the war is ongoing.

This War has had a major impact on supply chain activities among Eastern and Western Countries. Due to this, there is an impact on Importation and exportation from both countries, fuel price increases, longer shipment lead times, insecurity in shipping through Russia-Ukraine border routes, alliance countries getting attacked on the trading, and shortage of agricultural products.

Ukraine Trade - Annual (2017-2023)

Russia Trade - Annual (2017-2023)

This war has affected direct and indirect maritime activities such as the damage caused in the Black Sea and Azov Sea due to attacks that impacted the trade routes, The Russian ships are restricted from accessing EU Ports, fuel costs have risen, finding different trade routes, long transit time and so on. Read this article for detailed information https://www.oecd.org/ukraine-hub/policy-responses/impacts-of-russia-s-war-of-aggression-against-ukraine-on-the-shipping-and-shipbuilding-markets-4f925e43/

Marine insurance plays a major support for all businesses to overcome the risks involved in transporting the shipment within the destinations with all the risks involved. According to Lloydslist.com, in March 2022, over 300 Vessels and 1000 seafarers were struck in Ukraine due to invasion, among them around 128 were foreign-flagged vessels. Companies could at least overcome the financial loss due to the invasion.,

As a result, the major supply chain resilience in securing the business from financial risk is to insure the overall goods in the warehouse and the goods in transit. Thus, utilizing marine insurance is safer to overcome the risks involved while transporting the cargo, geo-political risk, risk due to bad weather or disaster, and insecure payment.

Never miss a story from us, get weekly updates in your inbox.

Never miss a story from us, get weekly updates in your inbox.